International arbitration in 2024

Energy transition: critical minerals industry challenges

By: Caroline Richard, Lee Rovinescu, Patrick Schroeder, Eric Leikin, Natalia Zibibbo

IN BRIEF

Soaring demand for minerals key to the energy transition will increasingly generate political, environmental and social challenges, potentially presenting an obstacle to the investments necessary to realize the energy transition. Considering energy and mining disputes are commonly settled by arbitration, many new cases in 2024 will likely focus on ESG concerns.

Countries and companies across the world are increasing spending on and diversifying into clean-energy or low-carbon energy sources. Renewables are expected to be the world’s top electricity source in 2025 and by 2030 one in four new cars sold worldwide is expected to be electric. (Some countries plan to completely ban combustion engine cars by 2030.)

The accelerating energy transition is fueling the demand for, and investment in, critical minerals needed to manufacture electric goods – notably, lithium, copper, cobalt, nickel and other rare earth elements. Rising demand and high prices doubled the market size of key energy transition minerals in the past five years, reaching $320bn in 2022. Demand for critical minerals is predicted to increase up to 500 percent in the next ten years.

Geographic concentration

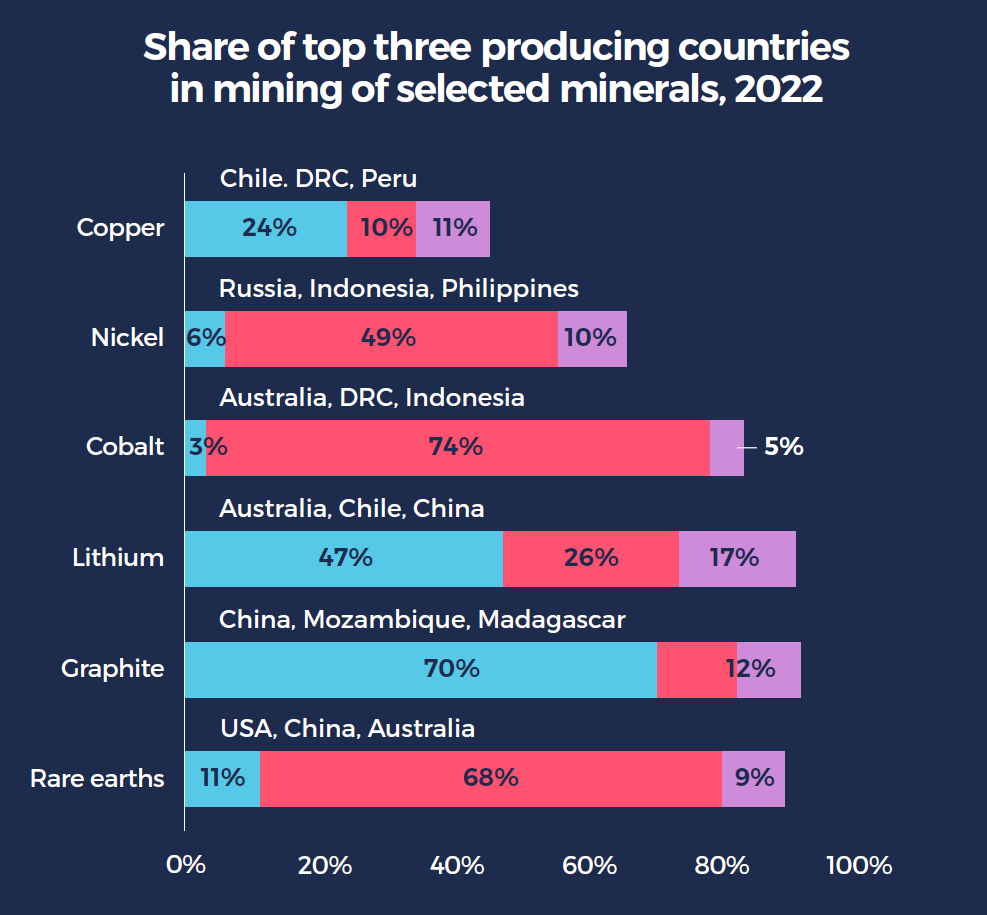

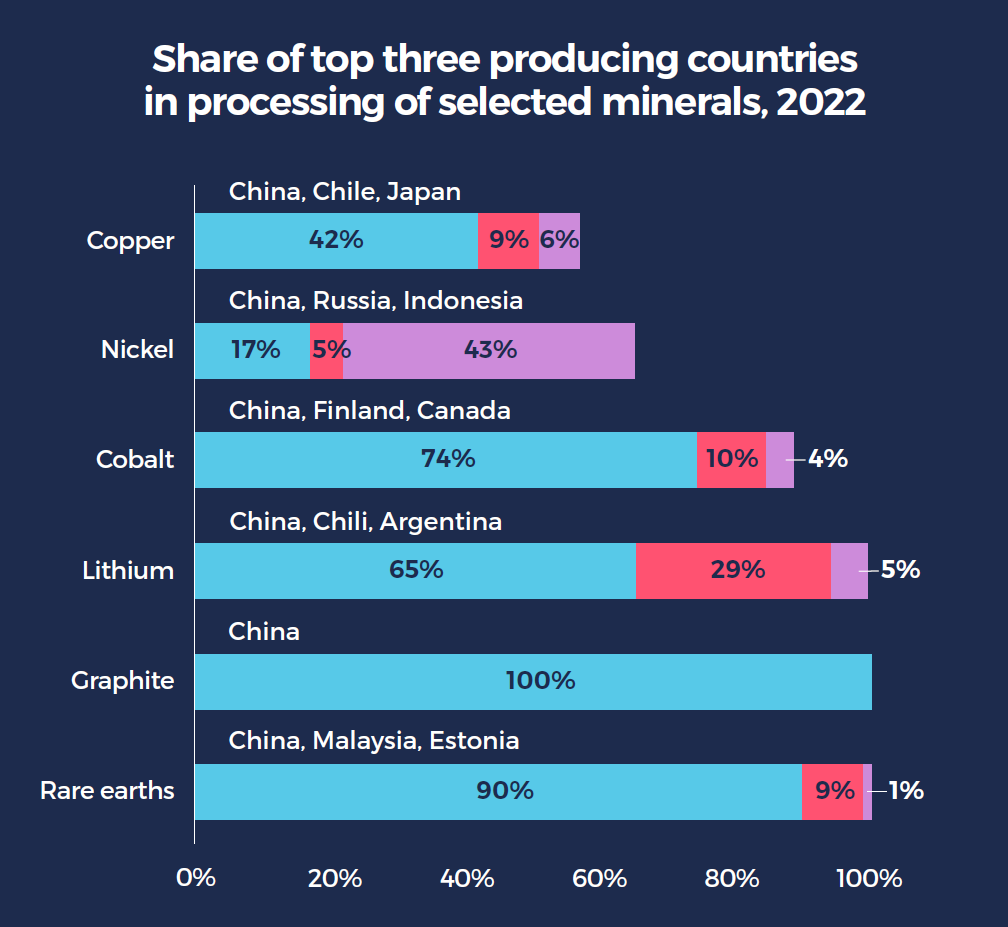

However, this rapidly growing market is concentrated geographically. The most important minerals are currently found in only a few countries, mostly in Latin America, Asia and Africa. Chinese companies control most of the global market for processing and refining several critical minerals.

Source: International Energy Agency, Share of top three producing countries in mining of selected minerals 2022 and Share of top three producing countries in processing of selected minerals 2022.

Against this background, we believe that investors in the critical minerals extraction and supply chain will likely face three main types of challenges and opportunities in 2024 and beyond.

Increasing State control

First, governments where critical minerals are located may further increase State control of the industry or up their share of economic benefits. For instance, both Mexico and Chile have already fundamentally changed the legal regime for lithium mining, granting the State more control over lithium resources.

In Africa and Asia, several countries (including Indonesia, Namibia and Zimbabwe) have decided to restrict or prohibit exports of critical raw minerals. Similarly, Malaysia announced that it will ban the export of rare earth raw materials to boost its domestic industry. Additional producing States are likely to follow in these footsteps in 2024.

Regulation and subsidies

Second, we expect the critical minerals sector to become both more regulated and more heavily subsidized as a result of national security concerns, particularly in Western countries.

For example, both the United States and the European Union are updating their regulations and investing in expanding their domestic critical minerals supply chain. Notably, the European Union’s Critical Raw Materials Act expects to reduce the administrative burden and simplify the permitting procedures for critical raw materials projects in the EU. However, EU Member States will have to increase their efforts to mitigate any adverse impacts with respect to labor rights, human rights and environmental protection.

In turn, Canada announced it would limit foreign State-owned companies’ participation and investment in the critical minerals industry. However, as shown by Canada’s ultimate backtracking from its efforts to force Chinese investors to divest from its three large mining companies, there may be limits to the intrusiveness of such government interventions.

ESG challenges to mining

Third, the mining of critical minerals will probably continue to face challenges from an ESG perspective, particularly related to the risk of environmental and social impact of the projects. For example, one study has shown that, of 120 mining projects located in Argentina and Chile, half are facing some type of community opposition. And a survey of professionals engaged in mining arbitrations predicts that environmental issues will be the main source of disputes in the near future. Mining projects across the world will continue to encounter community opposition related to water usage, biodiversity loss and the potential displacement of local communities.

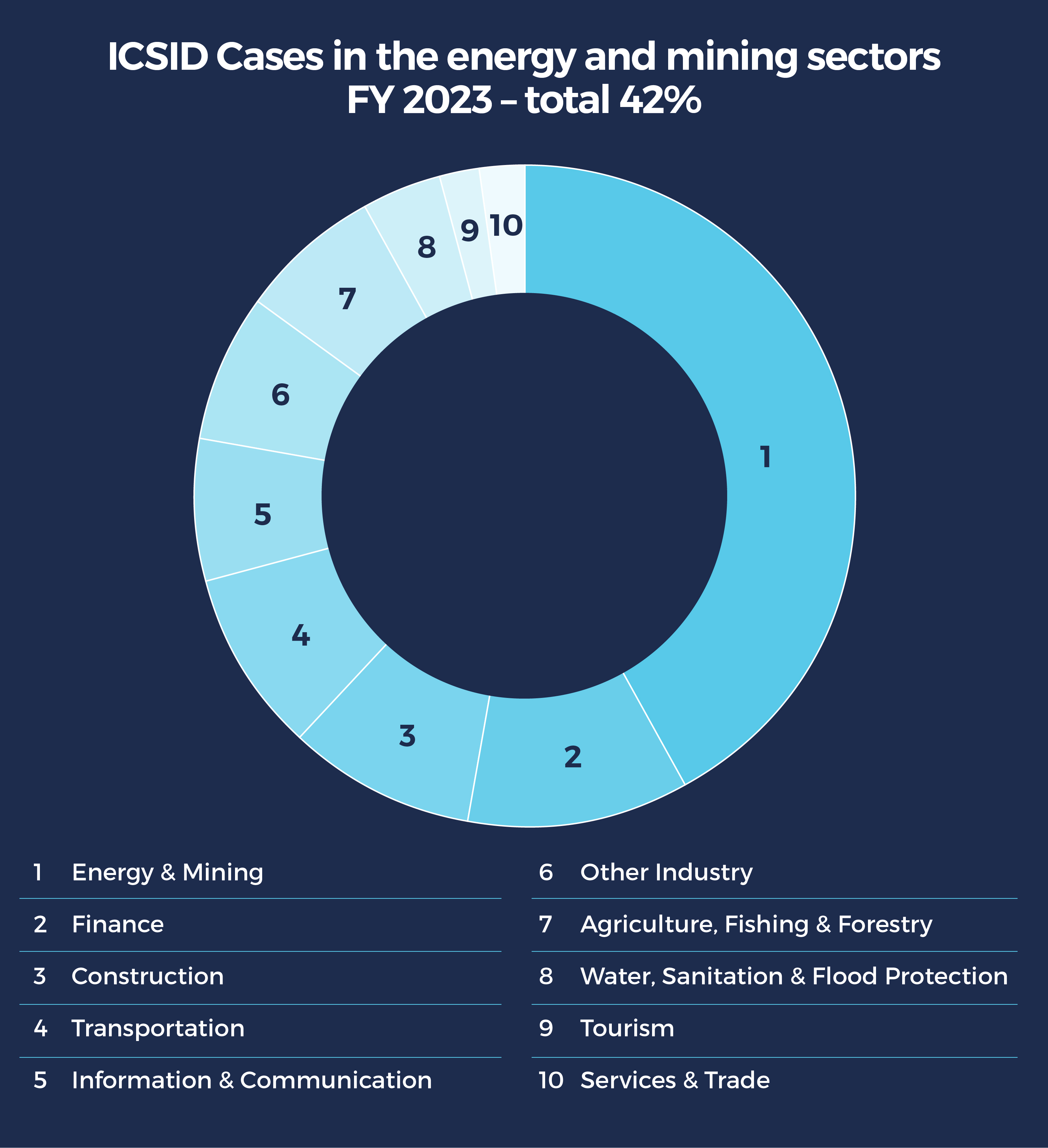

We expect this increase in energy- and mining-related disputes to be commonly settled by arbitration (including investment arbitration). Indeed, more than two in five cases ICSID cases registered in 2023 were related to the energy and mining sectors.

Source: ICSID, Annual Report 2023, page 29

Whether using arbitration or not, effective dispute resolution and prevention mechanisms will be key to mitigating risks.

Ideally, investors should consider carefully all potential risks to try to prevent disputes, for example by developing strong compliance programs, conducting due diligence to address ESG considerations, and engaging with relevant stakeholders well before starting a project or investing in one.

Natalia Zibibbo

Freshfields Counsel

Both investors and States should consider that failing to maintain the regulatory regimes specifically deployed by countries to incentivize investment, or introducing significant regulatory changes to those regimes, may breach protections granted to investors under international investment treaties and free trade agreements. Investors may, therefore, have access to remedies against host States’ measures limiting the investors’ return or enjoyment of their investment.

Investors in the critical minerals industry should consider structuring their investments through a jurisdiction that has in place a treaty with the host state protecting the investment. However, there are important differences between treaties and investors should carefully consider the different options.

Caroline Richard

Freshfields Partner

Top trends 2024

- Introduction

- Generative AI: opportunities and risks in arbitration

- Arbitration in times of crisis: conflict, sanctions, climate

- Energy transition: critical minerals industry challenges

- Arbitration Act 1996 reforms: ensuring London remains a leading seat for international arbitration

- EU campaign to end intra-EU investor-State arbitration: pushing investor creativity

- India: a new era for international arbitration?

- The evolving landscape of arbitrator conflicts and disclosure requirements

- Construction and environmental disputes from oil and gas decommissioning

- Public international law’s growing relevance for businesses

- Clarity or confusion? The implications of domestic court rulings for arbitration

- Is your life sciences contract susceptible to renegotiation or termination if the economics of the deal changes?

- Arbitration top trends archive