International arbitration in 2024

India: a new era for international arbitration?

By: Rohit Bhat, Vasuda Sinha, Stuti Gadodia

IN BRIEF

Some recent court decisions offer reason for cautious optimism regarding India’s arbitration ecosystem. Yet, as the landscape continues to evolve, investors should continue to plan strategically in respect of the dispute resolution avenues applicable to new investments.

Currently the world’s fifth largest economy, India is set to become the third largest by 2030. With its immense and growing population, consumer market and young labor force, India continues to be a priority for foreign investors.

Financial sponsors, technology leaders, energy majors, and automobile companies alike have bet heavily on India. India-related international disputes will increase in line with this economic activity.

India’s rise in arbitration

Arbitrations involving Indian parties are increasing in number, value and profile, such as Amazon’s challenge of the sale of an Indian retail business to Reliance.

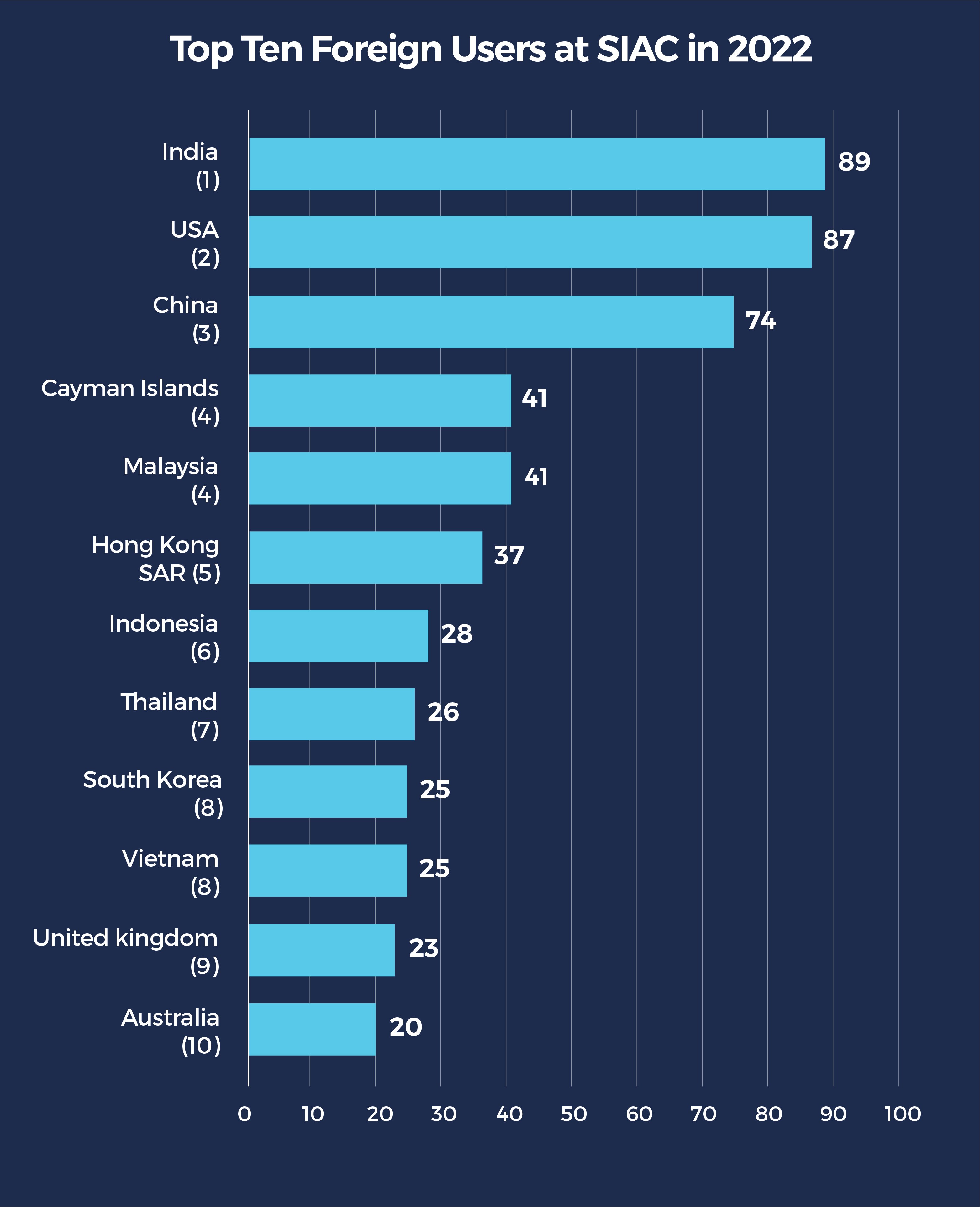

India has topped SIAC’s list of foreign users for four years in a row and the past two years saw nearly 300 Indian parties at SIAC. Indian parties also appear among the top ten users of ICC arbitration. Singapore remains the preferred seat for India-related arbitrations, while London and Dubai are also popular choices. We expect this trend to continue in 2024 and beyond.

Source: SIAC Annual Report 2022, page 24

Arbitration-friendly developments in India?

The increased use of and focus on arbitration means India is becoming more friendly to, and stable for, arbitration.

Historically, Indian courts have been known for interference in arbitral awards, often resulting in unpredictable results out-of-step with international norms. Amid a gradual shift, several pro-arbitration judgments from India’s Supreme Court and some key High Courts have:

- advocated for minimal interference in arbitral awards delivered by India-seated tribunals;

- recognized the need for swift enforcement and execution of foreign arbitral awards;

- confirmed that emergency arbitral awards in India-seated arbitrations are locally enforceable; and

- confirmed the role and legitimacy of third-party funding in arbitration.

Amendments to the Indian Arbitration and Conciliation Act complement this evolution in the judiciary’s approach. In June 2023, India appointed a high-level committee of experts to explore gaps in the regulation of arbitration in India. (This committee is expected to submit its report in Q1 of 2024.) While the committee has a general mandate, it is expected to address issues such as guidelines for third-party funding and arbitrator fees, and the need to clarify the power of the courts to remand arbitral awards or modify their damages components (which has been done in some cases).

Local arbitral institutions are leading an improvement in India’s arbitration ecosystem. The Mumbai Centre for International Arbitration (MCIA), the Delhi International Arbitration Centre and the more recent Institution of Arbitration, Mediation and Conciliation, Hyderabad (IAMC), are examples of new institutions seeking to compete against more established international institutions for India-related disputes. The MCIA saw a 20 percent increase in its caseload in 2022 and is now administering disputes with a total value of over $1bn.

While SIAC and the ICC will continue to lead in the near future, these Indian institutions are likely to gain a stronger foothold in coming years, especially in domestic India-seated arbitrations, a majority of which are currently ad hoc.

Changes in India’s treaty landscape

Although international commercial arbitration is on the rise, the number of investor-State disputes against India is likely to continue to decrease. Following India’s termination of most of its bilateral investment treaties (BITs) starting in 2017, investors have not been quick to start treaty claims under the sunset clauses of the terminated BITs, with only five known treaty cases arising in the intervening period.

Only a handful of BITs remain in force. Investor protection may also be available through a small number of trade or economic partnership agreements still in force that contain investor-State dispute resolution provisions; these include agreements with Japan, Singapore and South Korea.

India is actively seeking to leverage its global position in negotiating new investment treaties and trade agreements. On the BIT front, negotiations have been based on India’s 2016 Model BIT. However, this has been resisted by most of India’s major trading partners due to the narrow protection and recourse it offers to foreign investors.

India’s negotiation strategy has enjoyed limited success, with only Belarus, Kyrgyzstan and Taiwan (executed not by the States themselves, but by the India Taipei Association in Taipei and the Taipei Economic and Cultural Center in India) agreeing to BITs based on the 2016 Model BIT. India has also executed Joint Interpretative Statements with Colombia and Bangladesh, aligning the existing BITs with the 2016 Model BIT. In 2022, India and Mauritius executed a Joint Interpretative Statement regarding the terminated India-Mauritius BIT (which several investors have used for claims against India, including a recent case by an investor in the satellite space).

New free trade agreements (FTAs) feature heavily in India’s push to increase and diversify international trade. India is currently negotiating FTAs with important trading partners including the UK, EU, Israel and Canada. Notably, India’s recently concluded FTAs with UAE and Australia do not contain investor-State dispute resolution provisions, although it is unclear how the FTA with the UAE will interact with the newly concluded India-UAE BIT or what dispute resolution provisions the latter includes. But investors can expect the India-UK BIT (proposed to be finalized along with the FTAs) to contain balanced provisions concerning investment protection and dispute resolution. A key question is thus whether (and to what extent) India will make concessions to depart from the 2016 Model BIT given the UK’s strategic position as one of India’s closest economic allies.

Similarly, the EU, India’s third-largest trading partner, has proposed a draft Investment Protection Agreement containing broad provisions for investor protection; the draft agreement, like other investment treaties recently executed by the EU, provides for the establishment of a 15-member permanent tribunal for the resolution of investor-State disputes.

Investor protections and related dispute-resolution mechanisms continue to evolve alongside India’s treaty landscape. While things remain in flux, investors looking for more certainty regarding the scope of obligations and the dispute-resolution fora applicable to specific investments may benefit from seeking to negotiate the inclusion of specific commitments in investment contracts directly with the State or relevant State bodies.

India is actively negotiating new investment treaties and trade agreements. Investors are advised to keep a close eye on the scope of investor-State dispute settlement–if any–provided by these agreements. Beyond thinking carefully about treaty structuring, investors should consider the role of bespoke agreements in providing the stability and predictability for which they might otherwise rely on BITs.

Vasuda Sinha

Freshfields Counsel

Cautious optimism on arbitration in India

In 2024 we expect India to remain an exciting jurisdiction for investors and arbitration stakeholders to watch.

On balance, the environment appears to be stabilizing in an "arbitration-friendly" direction. Nevertheless, investors should remember that India’s vastness and diversity is manifested in its court system: risks around unduly long enforcement or interim relief proceedings where local courts are involved will remain. Commercial parties seeking greater certainty or predictability should think carefully before designating India as the seat in arbitration agreements.

Additionally, as BIT and FTA negotiations progress, investors looking to preserve the possibility of recourse under international law must consider treaty structuring when planning investments in India.

India is a priority for foreign investors, and as India continues to grow, we are likely to see more disputes. Despite making significant efforts to improve its arbitration ecosystem, there remains the risk of undue delay in the Indian courts. Foreign parties looking for greater certainty should continue to designate a seat outside India.

Rohit Bhat

India Disputes Lead

Top trends 2024

- Introduction

- Generative AI: opportunities and risks in arbitration

- Arbitration in times of crisis: conflict, sanctions, climate

- Energy transition: critical minerals industry challenges

- Arbitration Act 1996 reforms: ensuring London remains a leading seat for international arbitration

- EU campaign to end intra-EU investor-State arbitration: pushing investor creativity

- India: a new era for international arbitration?

- The evolving landscape of arbitrator conflicts and disclosure requirements

- Construction and environmental disputes from oil and gas decommissioning

- Public international law’s growing relevance for businesses

- Clarity or confusion? The implications of domestic court rulings for arbitration

- Is your life sciences contract susceptible to renegotiation or termination if the economics of the deal changes?

- Arbitration top trends archive

Our team

-

Rohit Bhat Senior Associate and Lead, India Disputes

Singapur

-

Vasuda Sinha Counsel

Paris

-

Stuti Gadodia Principal Associate

Frankfurt am Main